Research Whitepapers

Simplifying Financial Data Management: Automating Bank Statements with Nanonets

Introduction

Managing financial data effectively is crucial for businesses, particularly when processing large volumes of bank statements. Traditional manual methods are time-consuming, error-prone, and inefficient. Automation offers a transformative solution by enhancing accuracy, efficiency, and compliance. Nanonets, an AI-powered platform, automates the extraction and processing of bank statements, turning unstructured data into actionable insights. With integrations into platforms like QuickBooks, Xero, SAP, and Zoho Books, Nanonets provides an advanced solution for financial data management.

Services

Nanonets offers a wide range of services to simplify the management of bank statements and financial data:

- Automated Data Extraction

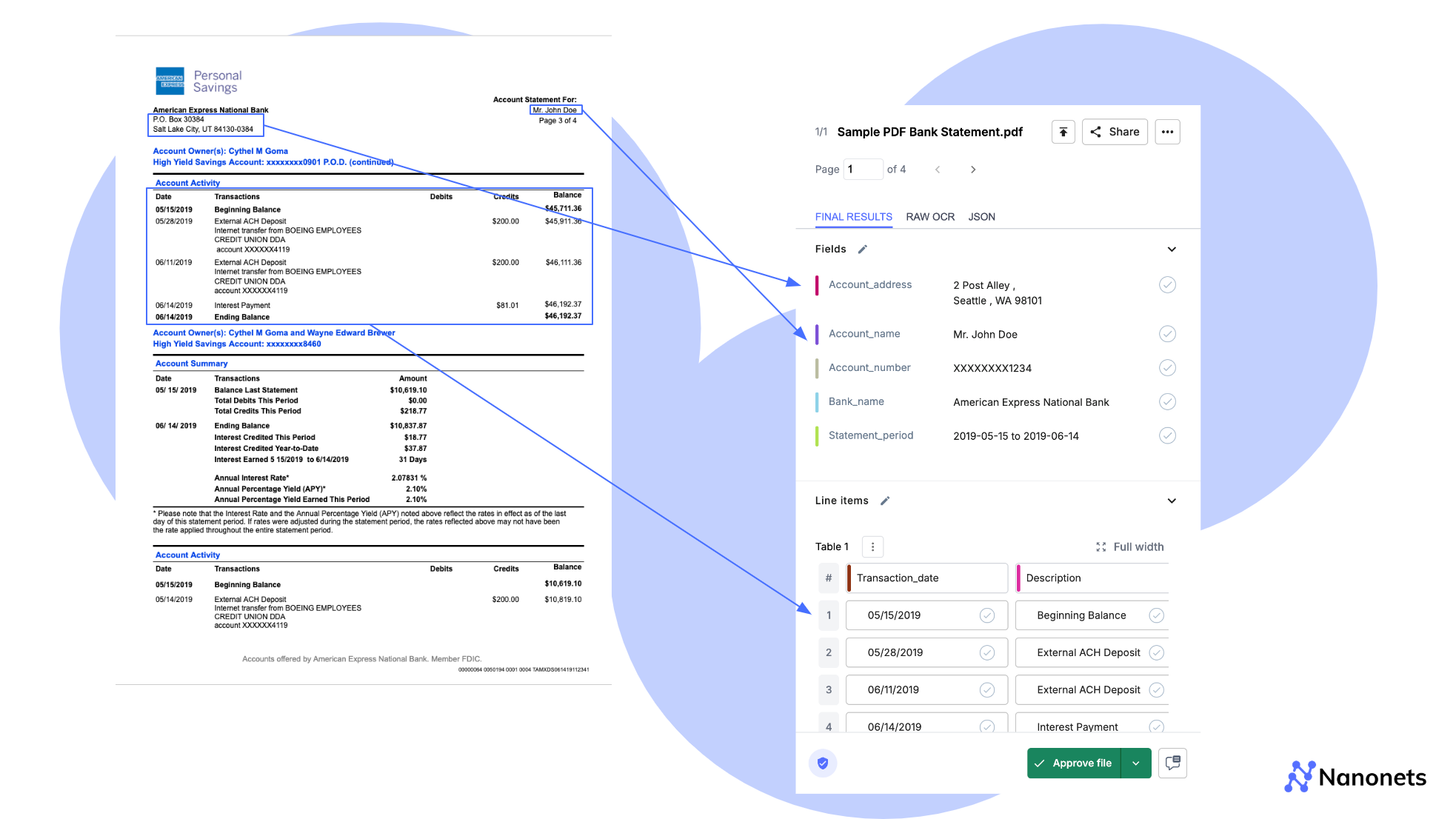

Using advanced OCR technology, Nanonets accurately extracts transaction details, account information, and balances from various bank statement formats, including PDFs and scanned images. This automation eliminates manual data entry errors and reduces processing times. - Seamless Integration with Accounting Systems

Nanonets integrates seamlessly with accounting platforms like QuickBooks, Xero, and Zoho Books. This ensures that extracted data is automatically imported into accounting software, streamlining bookkeeping and financial reporting processes. - Custom Workflow Automation

The platform allows businesses to create custom workflows for automating approvals, notifications, and data routing. Integrations with tools like Microsoft Power Automate further enhance workflow efficiency. - Data Validation and Reconciliation

Nanonets offers automated validation and reconciliation by cross-referencing extracted data with existing financial records. This ensures accuracy and highlights any discrepancies for review. - Regulatory Compliance Monitoring

The platform adheres to data protection standards such as GDPR and SOC 2, ensuring secure handling of sensitive financial data while maintaining compliance with regulatory requirements.

Technologies

Nanonets employs advanced technologies to ensure efficient and secure financial data management:

- Optical Character Recognition (OCR)

OCR technology converts unstructured bank statement data into structured formats, enabling accurate data extraction from PDFs, images, and handwritten notes. - Artificial Intelligence (AI) and Machine Learning (ML)

AI and ML algorithms adapt to various bank statement layouts, improving accuracy over time. These technologies ensure consistent data extraction across diverse formats and use cases. - Natural Language Processing (NLP)

NLP capabilities extract textual details like transaction descriptions, payment references, and account details, providing deeper insights into financial data. - API Integrations

Nanonets integrates with financial platforms such as SAP, Oracle NetSuite, and FreshBooks, enabling seamless data sharing across systems. - Cloud-Based Infrastructure

Powered by AWS and Google Cloud, Nanonets ensures scalability, data security, and real-time processing capabilities.

Features

Nanonets provides robust features tailored to optimize financial workflows:

- Dynamic Template Recognition

The platform automatically adapts to varying bank statement layouts, ensuring consistent and accurate data extraction without requiring manual template setup. - Batch Processing for Large Volumes

Businesses can process hundreds of bank statements simultaneously, significantly reducing turnaround times and improving operational efficiency. - Custom Metrics and Reporting

Organizations can define and monitor financial KPIs, such as cash flow trends or transaction volumes, through integrations with tools like Tableau and Power BI. - Error Detection and Validation

Extracted data undergoes real-time validation, flagging inconsistencies and highlighting areas requiring review. - Regulatory Compliance Management

Automated tracking of compliance requirements ensures adherence to financial regulations, including GDPR and PCI DSS. - Secure Data Sharing

Nanonets integrates with collaboration tools like Microsoft Teams and Slack for secure and efficient data sharing among stakeholders.

Conclusion

Nanonets simplifies financial data management by automating the extraction, validation, and integration of bank statements into existing systems. The platform’s compatibility with tools like QuickBooks, Xero, SAP, and Zoho Books ensures seamless workflows, reduced manual effort, and accurate financial records. By leveraging technologies such as OCR, AI, and NLP, Nanonets provides a secure and scalable solution for modern financial operations, empowering businesses to focus on strategic initiatives and data-driven decision-making.

Let’s Connect

At NextGen Coding Company, we’re ready to help you bring your digital projects to life with cutting-edge technology solutions. Whether you need assistance with AI, machine learning, blockchain, or automation, our team is here to guide you. Schedule a free consultation today and discover how we can help you transform your business for the future. Let’s start building something extraordinary together!